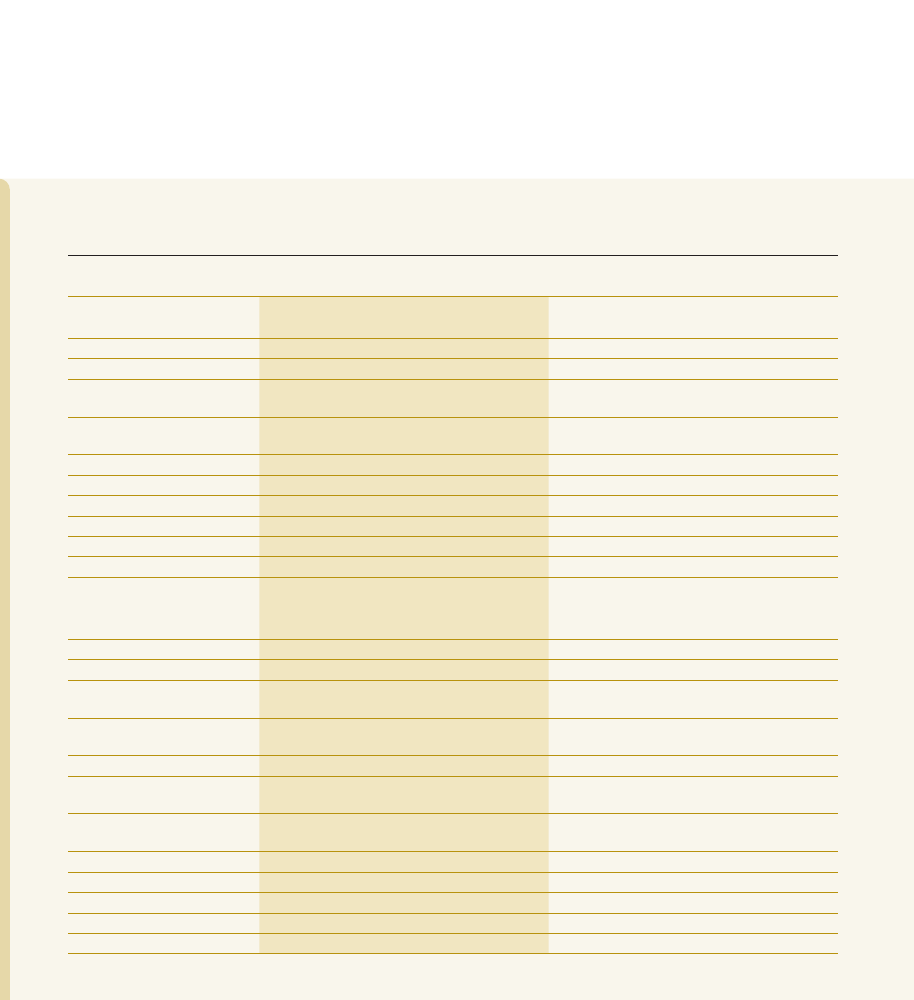

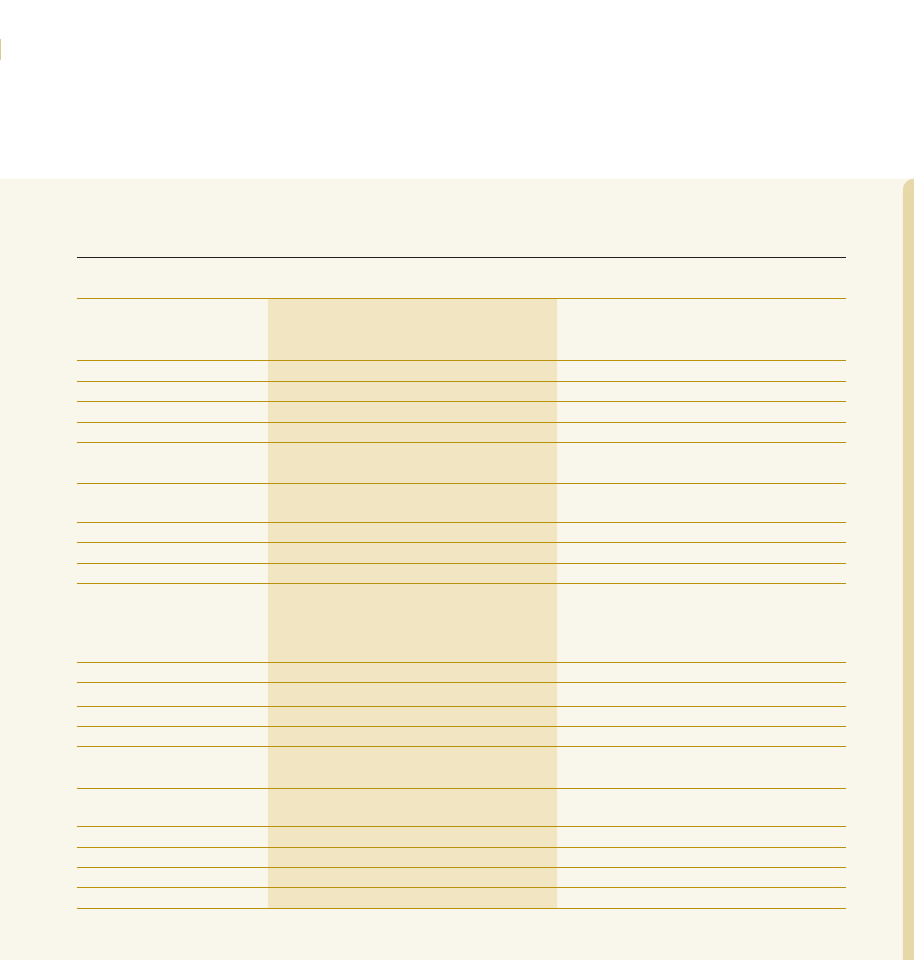

QUARTERLY PERFORMANCE

Summary of the Statement of Profit or Loss

2023

2022

31-Mar

30-Jun

30-Sep

31-Dec

31-Mar

30-Jun

30-Sep

31-Dec

LKR million

LKR million

LKR million

LKR million

LKR million

LKR million

LKR million

LKR million

Bank

Net interest income

18,654

9,913

22,652

39,969

39,806

41,004

27,106

18,431

Non interest income

(648)

(1,810)

6,000

5,627

18,375

13,154

9,061

9,806

Non interest expense

(11,777)

(12,427)

(13,406)

(14,647)

(10,168)

(11,359)

(11,806)

(13,965)

Impairment (charge)/ reversal for

loans and other losses

(1,068)

14,161

682

(8,869)

(36,836)

(26,934)

(16,252)

(7,133)

Operating profit before taxes on

financial services

5,161

9,837

15,928

22,080

11,176

15,865

8,109

7,139

Taxes on financial services

(1,831)

(2,702)

(3,761)

(4,370)

(2,301)

(2,890)

(2,480)

(3,642)

Profit before income tax

3,330

7,135

12,167

17,710

8,875

12,975

5,629

3,497

Income tax expense

(21)

(1,932)

(2,611)

(9,085)

(3,411)

(2,524)

(2,556)

9,487

Profit after income tax

3,309

5,203

9,556

8,625

5,464

10,450

3,073

12,984

Other comprehensive income

(6,133)

(5,189)

(8,390)

(9,277)

5,287

16,706

3,058

2,758

Total comprehensive income

(2,824)

14

1,166

(652)

10,751

27,156

6,131

15,742

Group

Net interest income

19,733

11,043

23,770

40,964

40,888

41,763

27,792

19,325

Non interest income

(255)

(1,816)

6,794

6,428

18,707

13,130

9,430

9,915

Non interest expense

(12,782)

(13,565)

(14,483)

(16,185)

(11,419)

(12,127)

(12,738)

(15,000)

Impairment (charge)/ reversal for

loans and other losses

(1,128)

14,195

759

(8,777)

(36,801)

(27,800)

(15,793)

(6,900)

Operating profit before taxes on

Financial Services

5,568

9,857

16,840

22,430

11,375

14,966

8,691

7,340

Taxes on financial services

(1,847)

(2,742)

(3,905)

(4,461)

(2,380)

(2,869)

(2,510)

(3,683)

Operating profit after taxes on

financial services

3,721

7,115

12,935

17,969

8,995

12,097

6,181

3,657

Share of profit/ (losses) of

associate companies, net of tax

25

3

27

(22)

37

33

21

31

Profit before income tax

3,746

7,118

12,962

17,947

9,032

12,130

6,202

3,688

Income tax expense

(95)

(2,020)

(2,843)

(9,198)

(3,477)

(2,549)

(2,625)

9,448

Profit after income tax

3,651

5,098

10,119

8,749

5,555

9,581

3,577

13,136

Other comprehensive income

(6,122)

(5,196)

(8,598)

(7,479)

6,793

17,196

3,554

4,795

Total comprehensive income

(2,471)

(98)

1,521

1,270

12,348

26,777

7,131

17,931

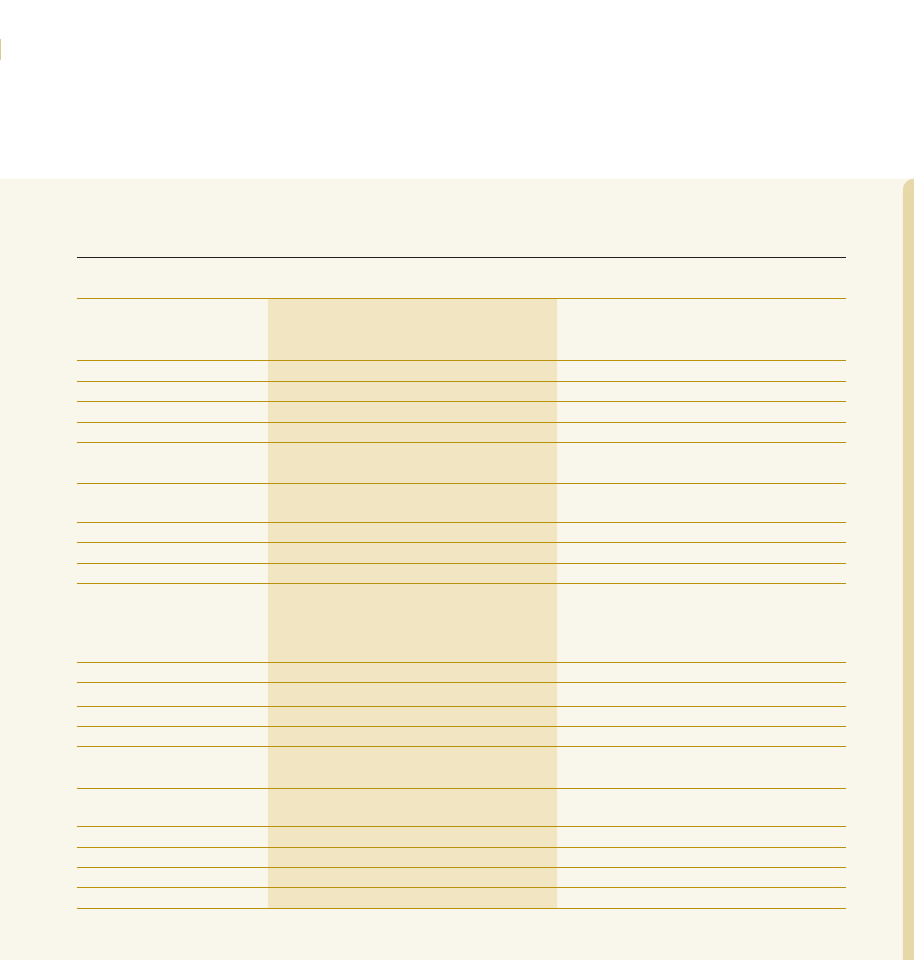

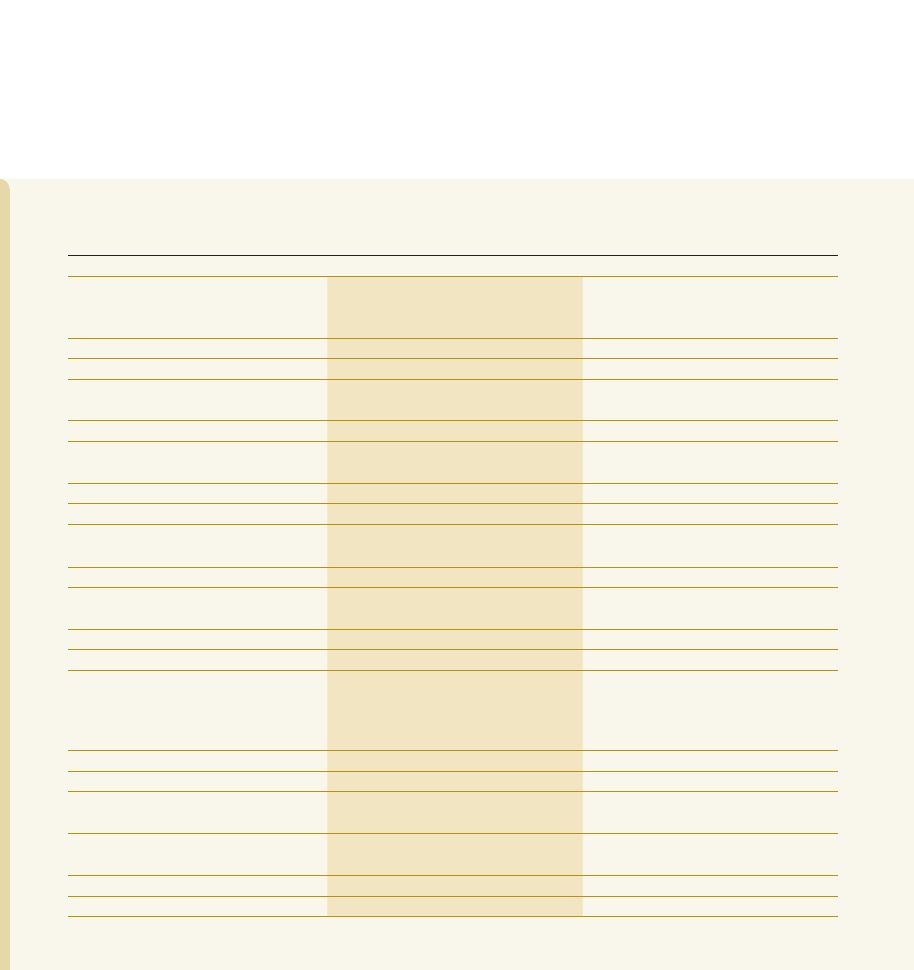

Summary of the Statement of Financial Position

2023

2022

31-Mar

30-Jun

30-Sep

31-Dec

31-Mar

30-Jun

30-Sep

31-Dec

LKR million

LKR million

LKR million

LKR million

LKR million

LKR million

LKR million

LKR million

Bank

Assets

Investments

1,466,806

1,546,245

1,760,032

1,830,857

1,458,047

1,587,610

1,603,157

1,601,082

Loans and advances to customers

2,132,577

2,082,899

2,136,680

2,209,062

2,430,684

2,505,856

2,363,664

2,325,594

Property, plant and equipment

42,490

42,722

42,461

50,043

39,069

38,536

38,509

41,704

Other assets

423,648

365,726

360,947

321,786

273,609

334,677

397,169

368,080

Total assets

4,065,521

4,037,592

4,300,120

4,411,748

4,201,409

4,466,679

4,402,499

4,336,460

Liabilities and equity

Due to customers

3,310,472

3,409,055

3,688,050

3,882,232

3,127,716

3,252,061

3,314,049

3,334,774

Debt securities and borrowed

funds

420,489

293,829

233,686

179,869

785,335

778,349

685,420

645,982

Other liabilities

83,373

83,507

126,017

97,932

77,021

204,514

164,588

101,520

Equity

251,187

251,201

252,367

251,715

211,337

231,755

238,442

254,184

Total liabilities and equity

4,065,521

4,037,592

4,300,120

4,411,748

4,201,409

4,466,679

4,402,499

4,336,460

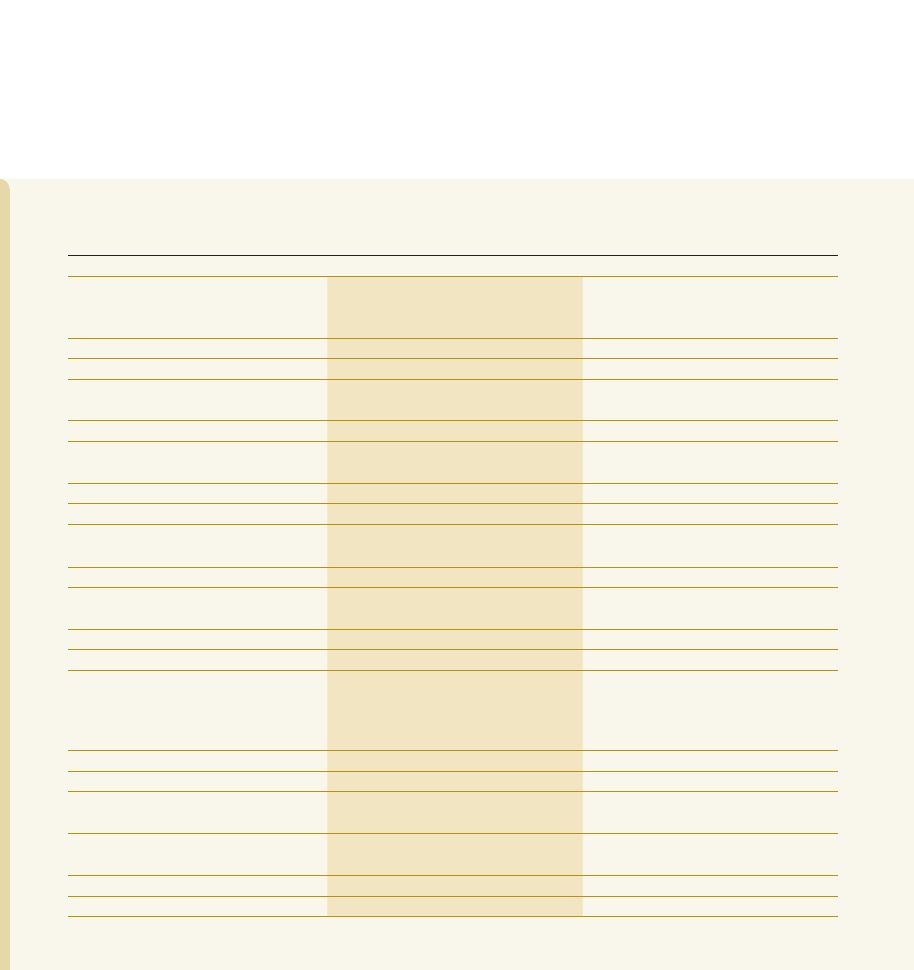

Group

Assets

Investments

1,471,148

1,551,044

1,768,944

1,838,501

1,458,210

1,593,247

1,604,941

1,603,720

Loans and advances to customers

2,161,380

2,110,006

2,165,414

2,240,611

2,466,219

2,540,746

2,398,089

2,355,978

Property, plant and equipment

55,460

55,289

55,019

64,304

51,259

50,885

50,772

55,315

Other assets

430,485

374,387

358,680

324,344

275,413

336,140

403,144

375,756

Total assets

4,118,473

4,090,726

4,348,057

4,467,760

4,251,101

4,521,018

4,456,946

4,390,769

Liabilities and equity

Due to customers

3,334,166

3,431,407

3,712,361

3,909,581

3,146,490

3,278,528

3,340,117

3,358,198

Debt securities and borrowed

funds

425,756

300,584

233,073

181,753

794,519

783,884

691,043

652,127

Other liabilities

88,665

88,953

131,320

103,847

82,520

211,259

171,080

107,914

Equity

268,834

268,748

270,223

271,458

226,050

245,889

253,629

271,473

Non controlling interest

1,052

1,034

1,080

1,121

1,522

1,458

1,077

1,057

Total liabilities and equity

4,118,473

4,090,726

4,348,057

4,467,760

4,251,101

4,521,018

4,456,946

4,390,769

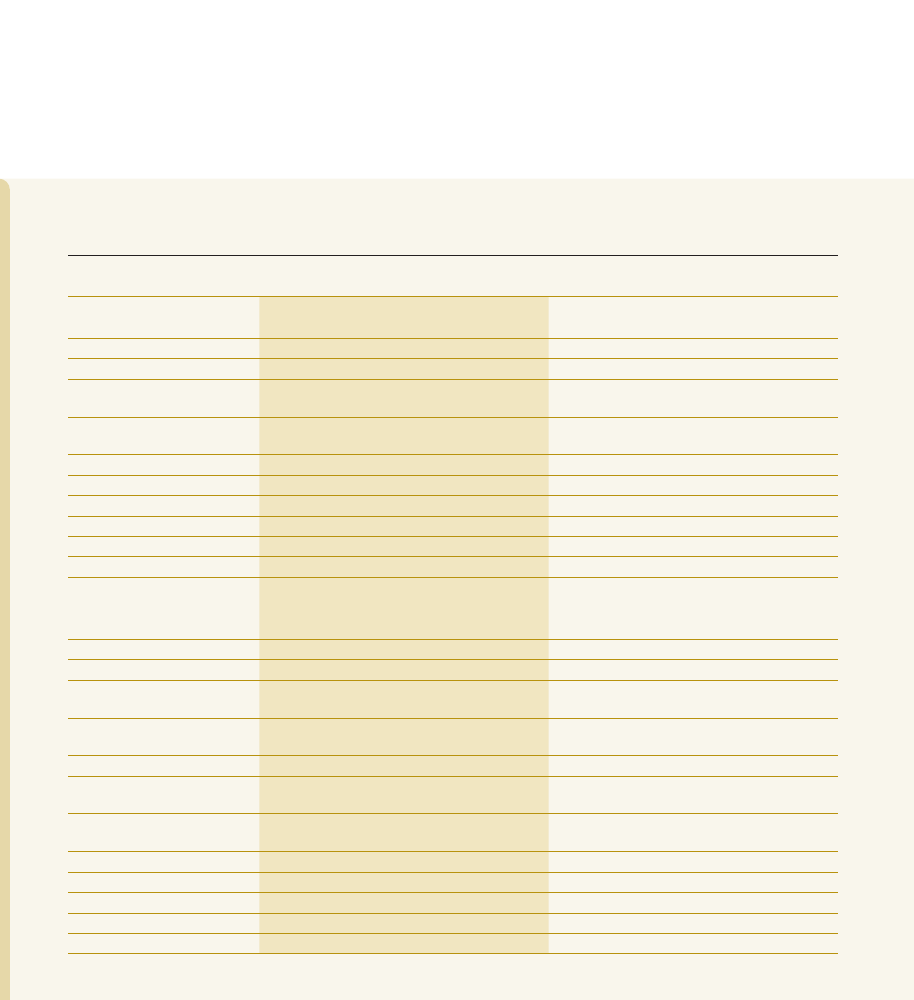

Summary of the Key Performance Indicators

2023

2022

31-Mar

30-Jun

30-Sep

31-Dec

31-Mar

30-Jun

30-Sep

31-Dec

Bank

Profitability

Interest margin (%)

1.8

1.4

1.6

2.1

3.4

3.9

3.5

3.1

Return on average assets (before tax) (%)

0.3

0.5

0.7

0.9

0.9

1.1

0.9

0.8

Return on average equity (after tax) (%)

5.2

6.7

9.5

10.6

10.6

14.7

11.5

14.1

Investor Information

Interest cover (times)

1.1

1.3

1.5

1.7

1.4

1.6

1.4

1.3

Net assets value per share (LKR)

10,047

10,048

10,095

10,069

8,453

9,270

9,538

10,167

Capital Adequacy Ratio

Common equity Tier I capital adequacy ratio, (%)

11.7

11.7

10.9

11.7

10.8

10.5

10.7

11.3

Total Tier I capital adequacy ratio, (%)

12.7

12.8

11.9

12.8

11.9

11.6

11.7

12.4

Total capital adequacy ratio, (%)

15.7

15.6

14.5

15.8

14.9

14.4

14.3

15.4

Assets Quality

Impaired loans (Stage 3) ratio

5.3

6.1

5.8

5.1

5.5

5.5

5.6

5.3

Impairment (Stage 3) to Stage 3 loans ratio

61.6

57.8

58.8

60.4

51.6

55.3

57.7

59.7

Regulatory Liquidity

Statutory liquid assets ratio

- Domestic banking unit (%)

26.7

32.7

41.3

42.8

30.5

21.7

21.0

21.2

- Off shore banking unit (%)

35.4

42.4

68.7

54.2

30.0

23.3

26.2

32.8

Group

Profitability

Interest margin (%)

1.9

1.5

1.7

2.2

4.0

3.9

3.6

3.2

Return on average assets (before tax) (%)

0.4

0.5

0.7

0.9

0.9

1.0

0.9

0.8

Return on average equity (after tax) (%)

5.4

6.5

9.3

10.1

10.0

13.1

10.6

13.1

Investor Information

Net assets value per share (LKR)

10,753

10,750

10,809

10,858

9,042

9,836

10,145

10,859

Capital Adequacy Ratio

Common equity Tier 1 capital adequacy ratio, (%)

11.8

11.8

11.2

12.1

10.8

10.5

10.9

11.4

Total Tier I capital adequacy ratio, (%)

12.9

12.9

12.3

13.1

11.9

11.5

11.9

12.4

Total capital adequacy ratio, (%)

15.8

15.8

14.9

16.2

14.9

14.2

14.5

15.3

QUARTERLY PERFORMANCE